A Proven Track Record

Our track record in the enterprise is unparalleled. Since 2009, we’ve partnered with more than 630 of the world’s most tenacious enterprise software companies, deployed over $6B in capital, and guided more than 200 portfolio companies to IPOs and acquisitions.

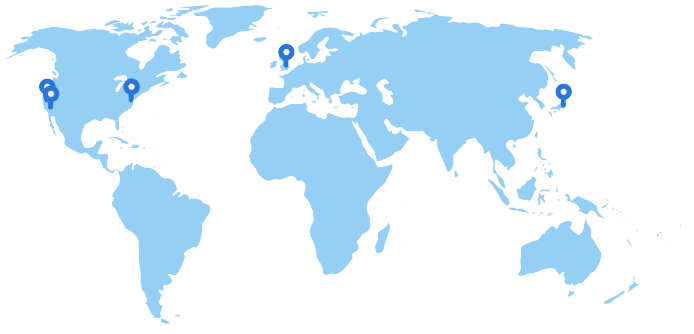

We believe innovation can come from anywhere. This is why we invest across the U.S., Europe, Israel, Japan, Korea, India, and Australia. Our global reach allows us to partner with visionary entrepreneurs from diverse markets, helping them unlock opportunities on an international scale.

I think what Salesforce Ventures brings is this real knowhow and this playbook of how to apply best practices to any company going through those similar scaling motions.

Apoorv Bhargava,

CEO & Co-Founder, WeaveGrid

Investment Strategy

Our strategy is simple: we leverage our decades of expertise in the cloud and our deep, long-term relationships with key decision-makers at thousands of businesses worldwide to give you a unique advantage. We help you build credibility, accelerate your growth, and unlock the resources you need to scale.

Our investment process is designed to be founder-friendly. As patient capital with the flexibility of an evergreen funding model, we’re equipped to invest at any stage as well as subsequent rounds to facilitate your growth. We also strive for a timely, streamlined investment review process so you can spend less time fundraising and more time building.

Our Values

We believe values drive value, and we lead with ours: courage, trust, equality, and mutual success. We earn the trust of our founders, partners, and the broader industry through transparency, sincerity, reliability, and integrity.

We see our role as a constructive partner in helping your business grow. We stand by your side as you build an industry-defining business. In a complex and uncertain world, we are the flexible, strategic counsel you need, ready to marshal our resources to meet the moment.

We believe diversity of experience and perspective shapes innovation. We actively promote best practices to build inclusive and impactful companies from the ground up through our Impact Fund and initiatives like Pledge 1% and Salesforce Ventures Gives Back.

$6B+

Capital Invested

675+

of the world’s most tenacious enterprise software companies from seed to growth

190+

M&A exits

39

Professionals Globally

35+

IPOs

130K+

Total active portfolio company employees

Frequently Asked Questions

What is Salesforce Ventures?

Salesforce Ventures is a VC dedicated to partnering with best-in-class entrepreneurs across the enterprise technology ecosystem. We provide enterprising founders with patient capital, coveted community, and privileged access to the resources they need to build industry-defining companies.

What do you invest in?

We invest globally in enterprise software companies that we believe will be the next generation of industry leaders. Our core investment areas are cloud infrastructure, security, AI, horizontal and vertical apps, and impact (e.g., climate tech, edtech, health tech, and financial inclusion). We do not generally invest in consumer software or hardware.

When do you invest?

We aim to support founders at all stages of the company-building lifecycle, from seed funding through the growth stage. Our investments range from < $5M for seed rounds to $50M+ for growth-stage rounds.

What does your investment process look like?

Our investment process is designed to be founder-friendly and align with the fast-moving VC landscape. With patient capital and the flexibility of an evergreen funding model, we’re capable of investing at any stage and supporting our entrepreneurs and their companies through future stages of growth. Our goal is a quick and straightforward process, so you can spend less time fundraising and more time building.

What do you mean by “patient capital”?

Salesforce Ventures doesn’t aim to make a quick return on our investments; we think in years and decades, not quarters. We believe that great companies can be built in any market cycle, but true innovation and outlier results require patience and commitment. We aim to partner with companies that will stand the test of time.

What is your track record to date?

Salesforce Ventures has invested over $6 billion in more than 630 companies globally to date. We’ve helped many incredible businesses grow and scale, including 35 IPOs and 175+ M&A exits. Notable investments include Anthropic, Box, Cohere, Databricks, DocuSign, Mulesoft, nCino, Snowflake, Wiz, and Zoom.

What is your relationship with Salesforce?

Salesforce Ventures was launched as Salesforce’s venture arm in 2009. Salesforce is the sole source of capital for Salesforce Ventures, and our mandate is to partner with best-in-class entrepreneurs and generate top returns.

Our singular focus is helping entrepreneurs build industry-defining businesses. Of the more than 630 investments we’ve made to date, Salesforce has acquired less than 5% of our portfolio companies.

What factors does your team consider when making investment decisions?

Salesforce Ventures invests in exceptional entrepreneurs, focusing on enterprise software companies tackling significant challenges in large markets. In the early stages, we look for visionary teams with unique solutions that address critical market gaps. At later stages, we emphasize signals of future growth and category leadership. Across all stages, we seek out teams that align with our values and share our vision of a more sustainable and equitable future.

What unique value can Salesforce Ventures offer me that other venture capital firms cannot?

Salesforce Ventures offers unmatched value by way of patient and committed capital, robust community, and privileged access to the resources you need to build an industry-defining company. We stand by our portfolio companies across all stages and market cycles. Partnering with us means joining one of the world’s most influential communities of enterprise startups. We provide unparalleled access to strategic partnerships, early product feedback, customer introductions, and connections with Fortune 500 decision makers — including a deep connection with Salesforce — to help you get to market faster and scale effectively.

Salesforce In the News

Locations

We believe that innovation can come from anywhere. We have locations in:

LONDON

SAN FRANCISCO

NEW YORK

TOKYO