Welcome, Altruist!

A digital-first custodian for modern wealth management.

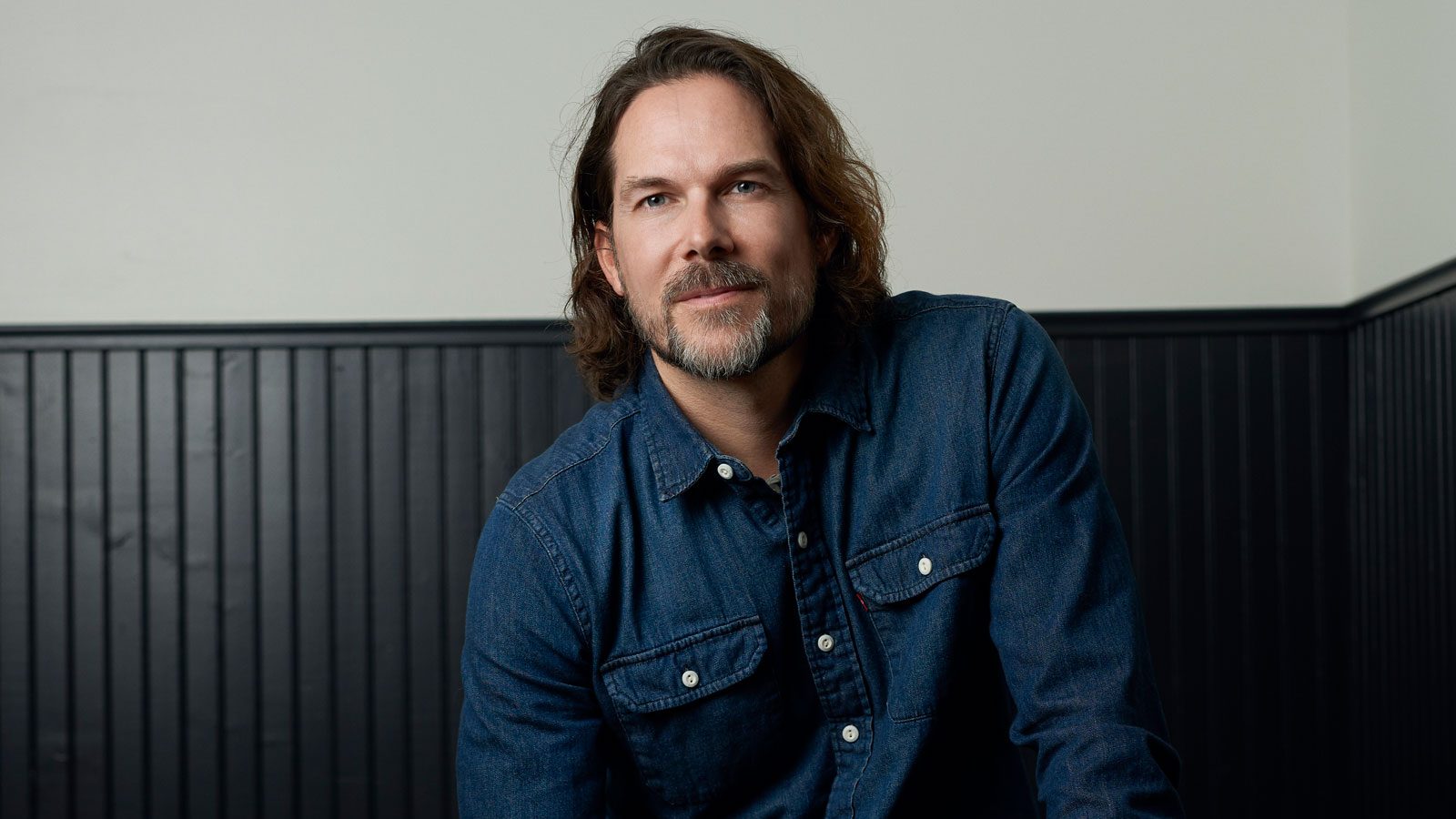

- Founder: Jason Wenk

- Sector: Financial Services

- Location: Los Angeles, CA

The Opportunity

The traditional wealth management software stack isn’t optimized: there are too many point solutions, too many portals, and systems don’t talk to each other — all of which leads to a disjointed experience for investors and advisors. Wealth management firms are feeling increased pressure to leverage better tech to deliver a smoother, more user-friendly experience.

This pressure is accelerated by the “Great Wealth Transfer,” where an estimated $84 trillion in the U.S. will move from the Baby Boomer generation to Millennials and Gen Z. This younger generation expects a more modern, digital-first wealth management solution.

These market tailwinds underpinned our recent investment in wealth management platform OneVest. Through that due diligence process, we learned how Registered Investment Advisors (RIAs) today are limited by the legacy custodians that’re entrenched in the market. These custodians act as a lynch pin of the wealth management stack and system of record — securely holding and managing investment assets on behalf of advisors and their clients while offering tools for trading, reporting, and compliance. Charles Schwab, Fidelity Institutional, and BNY Mellon Pershing are known as the “Big Three” custodians for independent advisors. Smaller RIAs report feeling underserved by these providers, citing high account minimums, nickel-and-dime fees, and service that can be impersonal or slow. What’s more, Schwab’s $25B acquisition of TD Ameritrade has left a void in the market for an independent financial custodian. This hybrid and independent RIA market is massive, totaling ~$9 trillion of AUM and growing 10% year-over-year.

Enter, Altruist.

The Solution

Altruist is a digital-first custodian with integrated portfolio accounting, performance reporting, billing, and trade balancing — enabling RIAs to operate more efficiently and at a lower cost compared to traditional platforms.

Altruist has built a fully featured platform from the ground up using modern architecture, with standout capabilities like fractional share trading. Unlike legacy providers — which tend to move slowly and rely on manual, resource-heavy processes — Altruist is digitally native, enabling rapid innovation and streamlined workflows. For example, RIAs can open and onboard new accounts in minutes, compared to the 2-3 week process typical of incumbents, which still utilize PDFs and occasionally mailed forms. For Altruist’s fast-growing customer base, featuring some of the fastest growing RIAs, that kind of friction is simply unacceptable.

Why We’re Backing Altruist

Like many great companies, our belief in Altruist starts with the team. Jason Wenk, Altruist’s Founder and CEO, is truly an N of 1 founder that’s uniquely qualified to build Altruist into a generational business. Jason has spent 20+ years working to make financial advice better, more affordable, and accessible to everyone. After successfully scaling his first business, Retirement Wealth Advisors, Jason founded FormulaFolios, which would go on to become the fastest growing RIA in the history of the industry — organically growing to nearly $4B AUM in just 6 years. With Altruist, Jason is building the custodial platform he would have wanted at his previous firms. And despite Jason’s success and reputation as a leading expert in the industry — along with the formidable network that comes with it — we’ve been continually impressed by Jason’s humility and empathy. He brings those qualities to Altruist and its customers every day.

Further, Jason has assembled a tremendous team around him, with Sumanth Sukumar joining as Chief Technology Officer and Rich Rao as Chief Business Officer.

The team has demonstrated remarkable product velocity, rolling out a suite of new offerings in 2024 — from a high-yield cash account to scalable tax management tools and a fully digital fixed-income trading experience. For the year, the team achieved triple-digit growth in key metrics like revenue, brokerage accounts, and advisors served. Altruist also continued to move upmarket, onboarding larger and more sophisticated RIAs, with a 43% increase in average firm size. The company now serves over 4,700 advisors and has tripled AUM for two consecutive years.

Finally, Altruist is a great complement to our wealth management offerings via Financial Services Cloud. Many of Altruist’s customers use Salesforce as their CRM, presenting an opportunity to expand value to our mutual customers and further unify the client/advisor experience.

What’s Ahead?

Salesforce Ventures is excited to invest in Altruist’s $150M Series F funding alongside our friends at GIC, Geodesic Capital, Baillie Gifford, Carson Family Office, ICONIQ and others.

We’ve been continually impressed by Jason’s ability to “think in decades,” while executing with urgency toward Altruist’s vision of becoming the custodian of the future. As the team advances toward product parity with legacy custodians, they’re also re-inventing how advisors engage with clients for the next generation of wealth management. Given Altruist’s role as the system of record in the wealth management stack, we’re especially excited about the potential to unlock AI applications built on top of their rich structured and unstructured data.

Welcome to the Salesforce Ventures portfolio, Altruist!